Build Smarter Financial Solutions with Mendix Low-Code

Speed up banking, insurance, and fintech innovation using low-code apps tailored for compliance, security, and customer experience.

Talk to a Mendix Expert

Key Benefits:

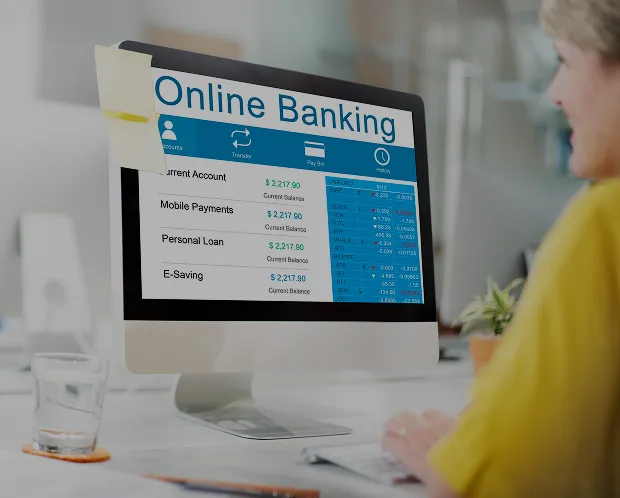

Automate approvals, reduce cycle time.

Integrate real-time checks and audits.

Improve transparency and resolution speed.

Launch fast, secure mobile solutions.

Offer 24/7 access to policy, statements, and support.

Track compliance workflows and reporting.

With years of experience in low-code and regulated industries, MXTechies helps banks and insurers launch digital solutions faster and smarter. We build reusable components, integrate seamlessly with core banking or legacy systems, and follow best practices for security and governance

60% faster time to market for new financial products

40% lower customer service expenses because to digital portals

30% improvement in claims processing efficiency

25% fewer compliance violations via audit-ready tools

Yes. Mendix supports integration with legacy systems through APIs, web services, and database connectors.

Mendix offers tools to meet compliance with GDPR, PSD2, PCI DSS, ISO 27001, and more.

Absolutely. You can build multi-user apps tailored to different roles and access levels—on desktop or mobile.

Yes. Mendix supports localization and internationalization features for global finance apps.

Whether you're digitizing claims, launching a new loan product, or modernizing internal tools—MXTechies can help you do it faster with Mendix.

Book a Free Consultation